The beginner introduction to OKX loan

At OKX, we believe in "borrow to earn, borrow to spend". We offer users easy access to a variety of crypto products by staking their existing assets. With OKX Loan, you can increase cash flow, and subscribe for new crypto products without exposing your portfolio to price volatility.

What's Flexible Loan?

Flexible Loan has no fixed term or pre-set interest rate. It supports over 140 types of crypto assets as collaterals. Funded by the liquidity pool of Earn, Flexible Loan offers a market-based interest rate that is updated on an hourly basis.

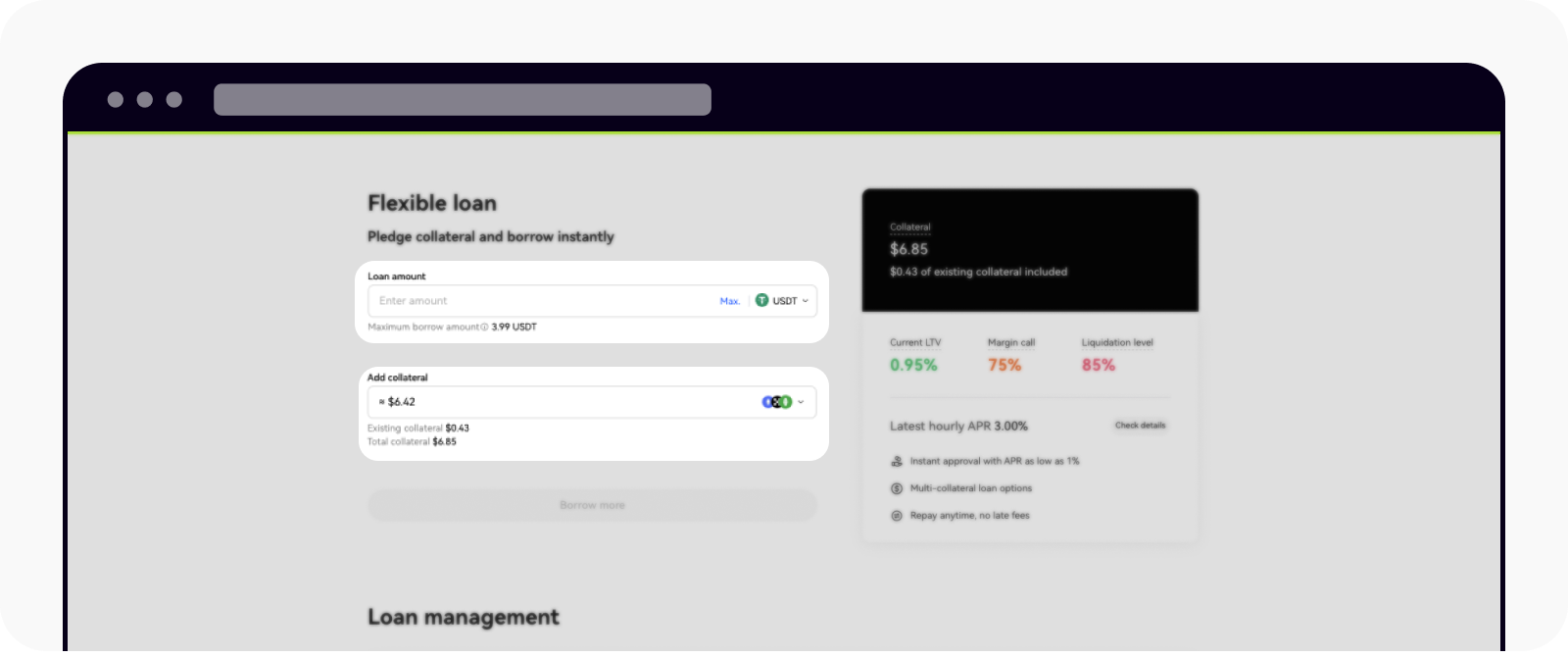

Fill in your loan amount and add your collateral to start borrowing.

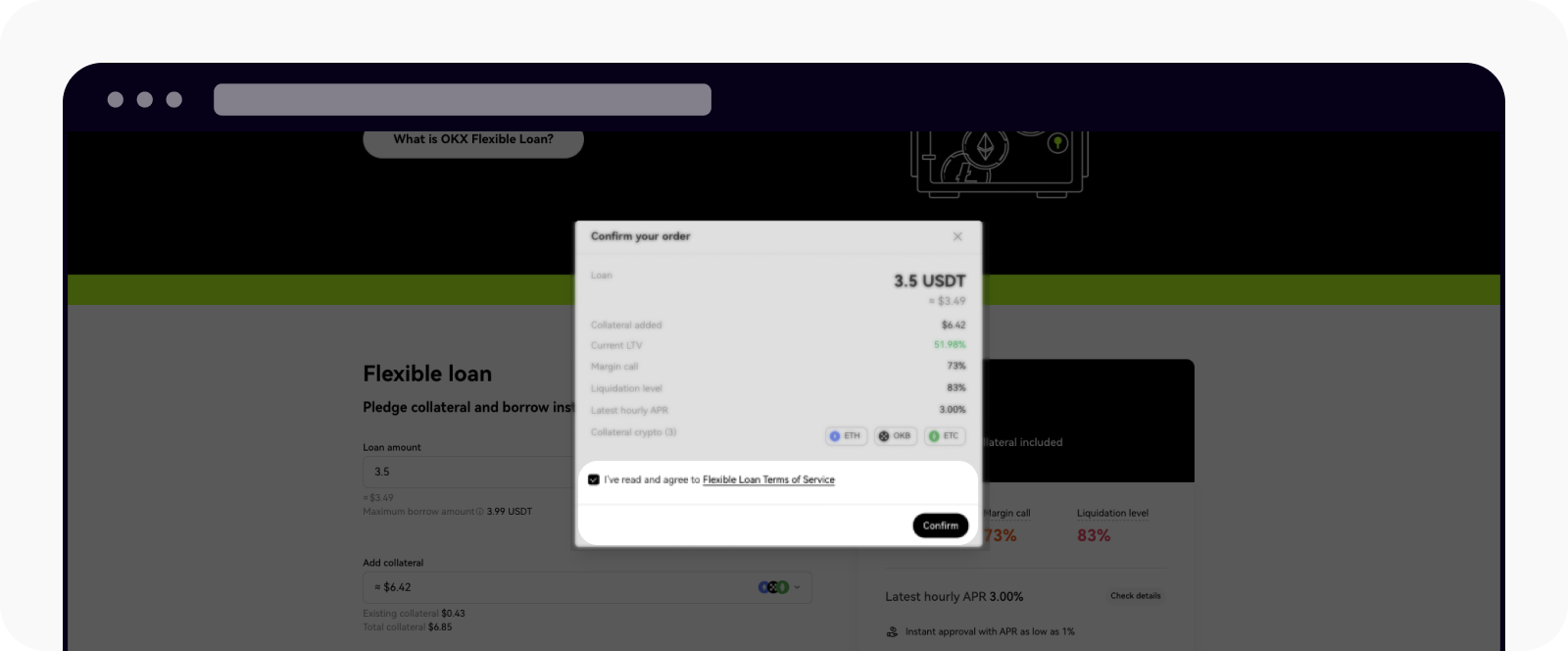

Check out the Flexible Loan terms of service before agreeing to proceed.

How can you borrow to earn?

Here are a few ways that you can tap into the value-added services offered by OKX Loan:

Loan x Jumpstart

Jumpstart is a platform for OKX users to explore promising crypto projects. It allows users to obtain new crypto simply by staking OKB. For those of you wary of price fluctuation, consider subscribing for new products with the OKB borrowed from Loan. This low-risk option allows you to participate in ICOs while holding onto your existing assets.Loan x Earn

Earn presents its users the opportunity to borrow and earn attractive APR via Simple Earn and On-chain earn. For risk-averse users, we recommend purchasing Earn products with crypto borrowed from Loan.

To take OpenDAO as an example: assuming that the current APR for SOS is 70%, if you borrow 10,000 SOS from Flexible Loan with an interest rate of 5%, you will be able to receive 6,500 SOS by the end of the loan term (10,000 * 70% - 10,000 * 5% = 6,500). This way, Loan x Earn allows you to sit back and enjoy high returns without fretting about price volatility.

How can you borrow to buy?

If you're in urgent need of liquidity but don't wish to sell off your crypto, consider borrowing USDT from Loan and exchanging it for fiat currencies.

How does cross-platform arbitrage work?

Assuming that OKX has a loan rate of 5% while another platform offers a 10% APR, feel free to borrow crypto from us to invest in other platforms.

How can you borrow to trade?

If you think that a crypto is going to surge or plummet, consider borrowing USDT from Loan to go long or short on the said crypto in the trading market. As you hit your desired price, simply pay off the loan and keep the profits.