Following in the footsteps of Lido and the the bonus liquidity it provides, crypto users might be pleased to read that liquid staking has made its way on Solana in the form of Jito.

As a liquid staking protocol operating on a stake pool model, Jito first caught attention when it announced a massive crypto airdrop for its native JTO tokens. Those tokens went to JitoSOL holders, Solana validators who used Jito Solana’s MEV clients, and users of Jito’s MEV services. This action seemed to breathe new life into Solana's ecosystem as total value locked (TVL) levels exponentially increased as more users got introduced to Jito.

Curious as to how Jito managed to capture the attention of many crypto traders and DeFi enthusiasts? From covering the basics of Jito as a liquid staking protocol to considering the tokenomics and utility of JTO tokens, here's everything you'll need to understand what is Jito and the excitement behind potentially trading JTO.

What is staking and liquid staking?

Before elaborating further, it's key to first understand the innovation of liquid staking and what it meant for the traditional staking model.

If you've been in the crypto scene for a while, you'll likely have come across staking and understand its popularity because of the passive gains it potentially offers. This process typically involves contributing crypto assets to validators who secure the network's consensus mechanism. In exchange, stakers earn a portion of the network's rewards for simply locking up the underlying coins and tokens. While this might have the potential for crypto traders to reap extra rewards while gaining exposure to their favorite cryptocurrencies, it comes with the drawback of illiquidity. This is because staked assets are typically locked for a predetermined period, hindering their immediate usability and limiting users' access to their capital.

Enter liquid staking — an innovation that has entirely disrupted the traditional staking model. Instead of locking up users' crypto assets, Jito pools them together and delegates them to validators on their behalf. However, the key differentiator lies in the issuance of JitoSOL, a synthetic token representing users' staked assets. JitoSOL remains freely tradable and accessible in the wallets of Jito users and grants them the liquidity they desire without compromising on staking rewards.

What is Jito?

Jito is one of Solana’s largest liquid staking protocols and operates on a stake pool model. It offers users JitoSOL in exchange for Solana deposited on Jito that's committed to on-chain staking. Jito is one of the early pioneers in bringing Maximal Extractable Value (MEV) enhanced liquid staking to Solana, allowing users to earn both staking rewards and MEV yield on their staked SOL tokens. The end goal for Jito is to create a mutually beneficial system where everyone can gain from Solana ecosystem inefficiencies.

To MEV or not to MEV

On the topic of MEV, MEV-based staking is often debated among crypto enthusiasts. While some may frame MEV as taking advantage of traders and manipulating the existing system, many fans of MEV point out that it's crucial as a method of further developing an ecosystem. By helping to identify and address inefficiencies within a network, MEV essentially works like an efficient arbitrage program in the realm of maximizing transaction value.

The history and origins of Jito

Jito's origins trace back to 2021 and is the brainchild of former Tesla engineer Lucas Bruder. Inspired by the untapped potential of MEV, Bruder envisioned a streamlined platform that's made accessible to everyday crypto users on Solana. Joined by Solana Labs co-founder Anatoly Yakovenko and backed by Solana Ventures and other investors, Bruder's vision materialized with $10 million in funding. This success paved the way for the Jito Foundation, a decentralized autonomous organization (DAO) overseeing Jito Labs and its mission to democratize MEV.

Understanding Jito's Block Engine

Compared to other liquid staking protocols on Solana, Jito's secret weapon is its Block Engine, a hyper-optimized transaction reordering engine that extracts MEV from the Solana network. It operates akin to a high-frequency trading system that accesses on-chain data and strategically reorders transactions within blocks to capture fleeting arbitrage opportunities and frontrunning potential. This generates additional yield for stakers on top of regular staking rewards, effectively squeezing more juice out of every Solana transaction. By employing advanced transaction simulation and deep learning algorithms, the engine continuously evolves, staying ahead of the curve and maximizing MEV capture for the Jito community.

How does Jito work: a step-by-step guide

Keen to give Jito a go? Here's a simple step-by-step process that'll explain the entire liquid staking process and allow you to enjoy MEV-empowered liquid staking gains:

Deposit your Solana: You start by depositing your Solana coins into Jito's platform. This gives Jito permission to use your crypto for staking and MEV capture.

Jito pools and delegates your SOL: Jito combines your Solana with other users' tokens into a large pool. This pool is then delegated to validators, who are responsible for securing the Solana network.

Earn staking rewards: As a reward for contributing to network security, you earn regular staking rewards. These rewards come from the network itself and are distributed based on the amount of Solana you've staked.

MEV capture for extra yield: Jito actively seeks out opportunities to capture MEV. MEV is essentially extra gains that can be extracted from certain blockchain transactions. Jito uses a proprietary system known as the Jito Block Engine to analyze transaction data and strategically order transactions to maximize MEV capture. This additional yield is then shared with you, boosting your overall earnings.

Receive JitoSOL: In exchange for your deposited Solana, Jito gives you JitoSOL tokens. These tokens represent your staked Solana and allow you to enjoy benefits like bonus liquidity and the benefit of dual rewards.

Ultimately, Jito's MEV-powered liquid staking allows you to earn staking rewards, capture additional MEV yield, and maintain liquidity and flexibility with your staked Solana — all while contributing to the security of the Solana network.

Unlocking the power of JitoSOL

JitoSOL empowers users in several ways, namely:

Earning double rewards: users earn both staking rewards generated through the delegated SOL and MEV rewards captured by Jito's proprietary optimization techniques. This occurs even when you're using them in other DeFi protocols and grants multiple streams of yield from your staked Solana.

Unleashing DeFi liquidity: JitoSOL tokens are freely tradable and usable in other DeFi applications. This means you're not locked into staking for a fixed period and can access the value of your staked assets whenever you need them. Examples of use across various DeFi protocols include participation in liquidity pools, lending platforms, and other yield-generating strategies on DApps like Orca and Kamino Finance.

What is JTO and what can it be used for?

JTO is a governance token that allows community members to participate in the Jito DAO and vote on all future critical decisions shaping Jito's future. This can range from protocol upgrades to fee structures. General governance utility aside, here are some other forms of JTO utility:

MEV shareholding: JTO holders get a slice of the MEV pie and get to enjoy additional gains captured by the Jito Block Engine.

Community access: JTO is your passport to exclusive Jito community events, airdrops, and early access to exciting new features.

Potential future staking pools: While it hasn't been officially announced, holding JTO could unlock access to special JTO-only staking pools with potentially higher rewards.

Potential future staking multiplier: The team is considering incorporating future JTO utility in that holding JTO tokens will boost your JitoSOL staking rewards. However, this is still under development and details haven't been finalized.

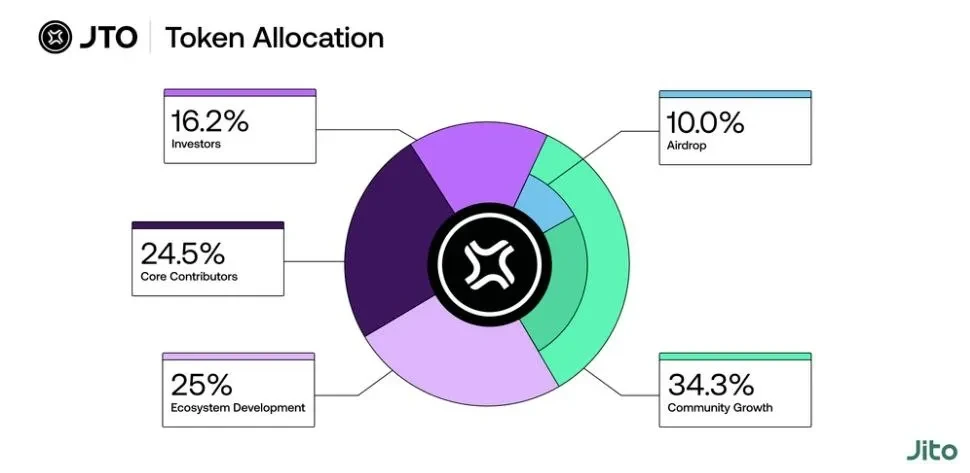

JTO tokenomics

Source: jito.network

With a total supply of 1 billion, JTO will be distributed as follows:

Community growth: 24.3% — to be managed by DAO governance on the Realms platform.

Ecosystem development: 25% — to be used for funding communities and contributors aiding the project’s growth.

Core contributors: 24.5% — to be allocated to the Jito team, which includes Jito Foundation employees, partners, and other internal project contributors.

Investors: 16.2% — to be distributed over three years with a one-year cliff.

Airdrop: 10% — 90% of which will be immediately accessible on distribution day, while the remaining 10% unlocks over a year.

The current popularity of Jito

According to Solana's statistics on DefiLlama, Jito ranks second when it comes to top DApps in terms of total value locked (TVL). As of December 5, 2024, Jito has an existing TVL of 6,486,953 SOL, 82 validators, and 126,010 unique stakers in pool. This makes it the most popular liquid staking platform on Solana and the sixth-most popular liquid staking platform overall. This is unsurprising given its generous staking APY of about 7.05% and conversion rate of 1 JitoSOL to about 1.08 SOL.

What lies in Jito's Future

Rather than rest on its laurels and be comfortable with having the Jito Labs client be run by over 31% of Solana validators, Jito is committed to innovating and improving beyond its current offerings. To date, Jito Labs is actively exploring initiatives such as:

Expanding DeFi integration: Jito plans to integrate and bridge with a wider range of DeFi protocols, offering users greater flexibility and earning potential.

Refining MEV optimization strategies: Jito plans to employ continuous research and development efforts to further refine Jito's MEV capture techniques, maximizing returns for stakers.

Driving community growth: Jito Foundation is planning to release more JTO tokens and distribute more rewards to promote engagement among Jito community members.

Ecosystem development: while Jito hasn't released an official road map, the team has hinted at plans to create other potential products that can run on the Solana blockchain. An example of this would be the StakeNet protocol announcement, a decentralized Solana stake pool manager that offers secure and transparent validator management, and autonomous stake operations.

The final world

Jito's liquid staking solution presents a compelling alternative to traditional staking on Solana. Despite it being relatively new, Jito has upped the competitive pressure on leaders in the staking field, so much so that Lido has sunset its staking product on Solana due to high development costs and increased competition.

By offering liquidity, enhanced rewards through MEV capture, and access to DeFi opportunities, Jito unlocks the full potential of users' staked assets. As the platform evolves and integrates with the fast-growing DeFi ecosystem, Jito has potential and could play a pivotal role in shaping the future of staking on Solana and beyond.

Fascinated by the future of liquid staking and interested in finding out more? Read up on the liquid staking competition by checking out our guide to Lido, one of the top liquid staking protocols on Ethereum.

© 2024 OKX。本文可以全文複製或分發,也可以使用本文 100 字或更少的摘錄,前提是此類使用是非商業性的。整篇文章的任何複製或分發亦必須突出說明:“本文版權所有 © 2024 OKX,經許可使用。”允許的摘錄必須引用文章名稱並包含出處,例如“文章名稱,[作者姓名 (如適用)],© 2024 OKX”。不允許對本文進行衍生作品或其他用途。